40 private equity fund structure diagram

en.wikipedia.org › wiki › Private-equity_firmPrivate-equity firm - Wikipedia Diagram of the structure of a generic private-equity fund A private-equity firm is an investment management company that provides financial backing and makes investments in the private equity of startup or operating companies through a variety of loosely affiliated investment strategies including leveraged buyout , venture capital , and growth ... PDF Fundamentals of Fund Formation: Structuring the Upper Tier Private Investment Funds Practice attorney. About Morgan Lewis's Private Investment Funds Practice Morgan Lewis has one of the nation's largest private investment fund practices and is consistently ranked as the "#1Most Active Law Firm" globally based on the number of funds worked on for limited partners by Dow Jones Private Equity Analyst.

Private Equity - Meaning, Investments, Structure, Explanation Private Equity Investments Raising PE capital from investors involves three crucial phases, i.e., pre-offering, offering and closing. Once convinced that the business holds potential, the PE firm invests in it through any of the following routes - Buyout or Leveraged Buyout: Here, the PE firm extends finance by buying the firm.

Private equity fund structure diagram

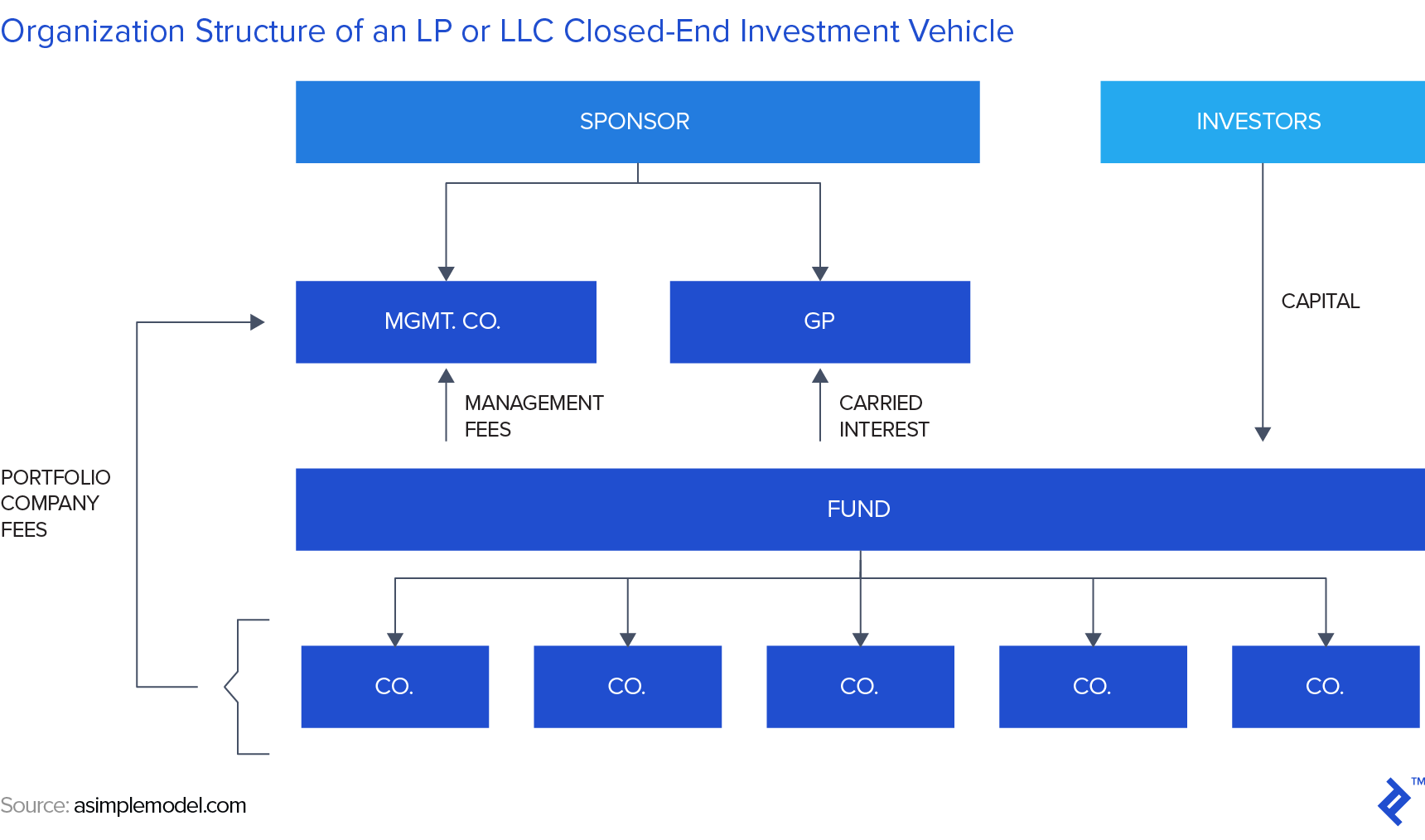

1-Private Equity Fund Structure | Download Scientific Diagram Download scientific diagram | 1-Private Equity Fund Structure from publication: The Patterns of Private Equity Investment in Ireland, 2007 - 2014 | Abstract Over the last decade developments of ... Private Equity Fund Structure | A Simple Model Private Equity Fund Structure. Peter Lynch ; Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no further funds can be raised. These funds are generally formed as either a Limited Partnership ("LP") or Limited Liability Company ("LLC"). ... › reporting-and-assessment › investorInvestor reporting guidance | Reporting guidance - PRI Oct 22, 2021 · For example, if a fund consists of 50% listed equity and 50% fixed income and accounts for 10% of a signatory’s total AUM – it should be reported as 5% listed equity and 5% fixed income. Why do we automatically get a 1-star score for some of our reported asset classes?

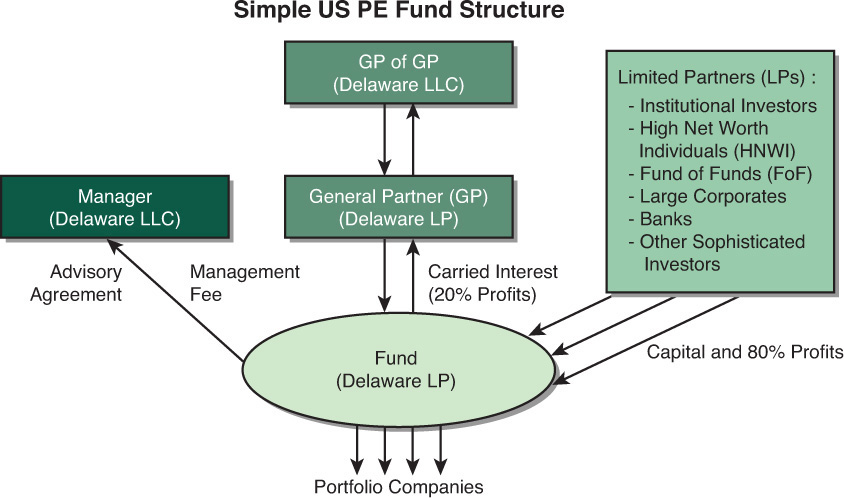

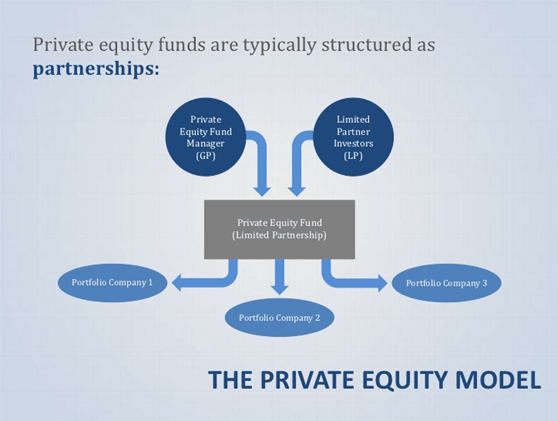

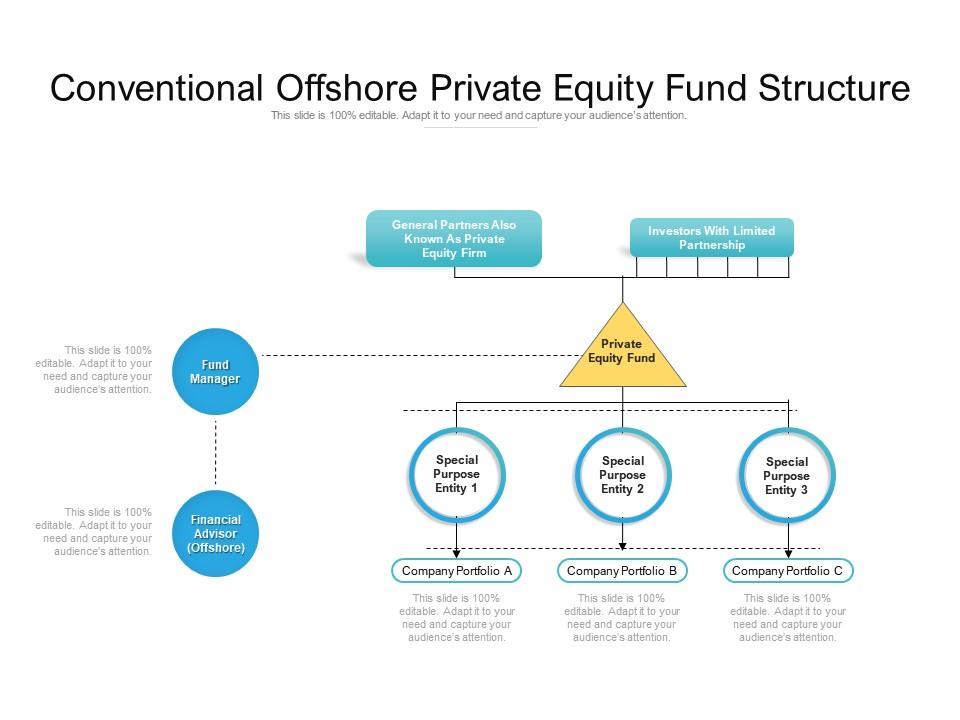

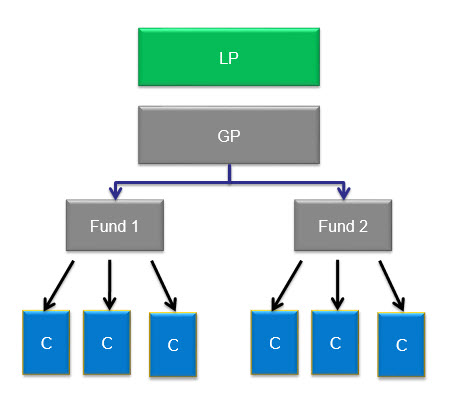

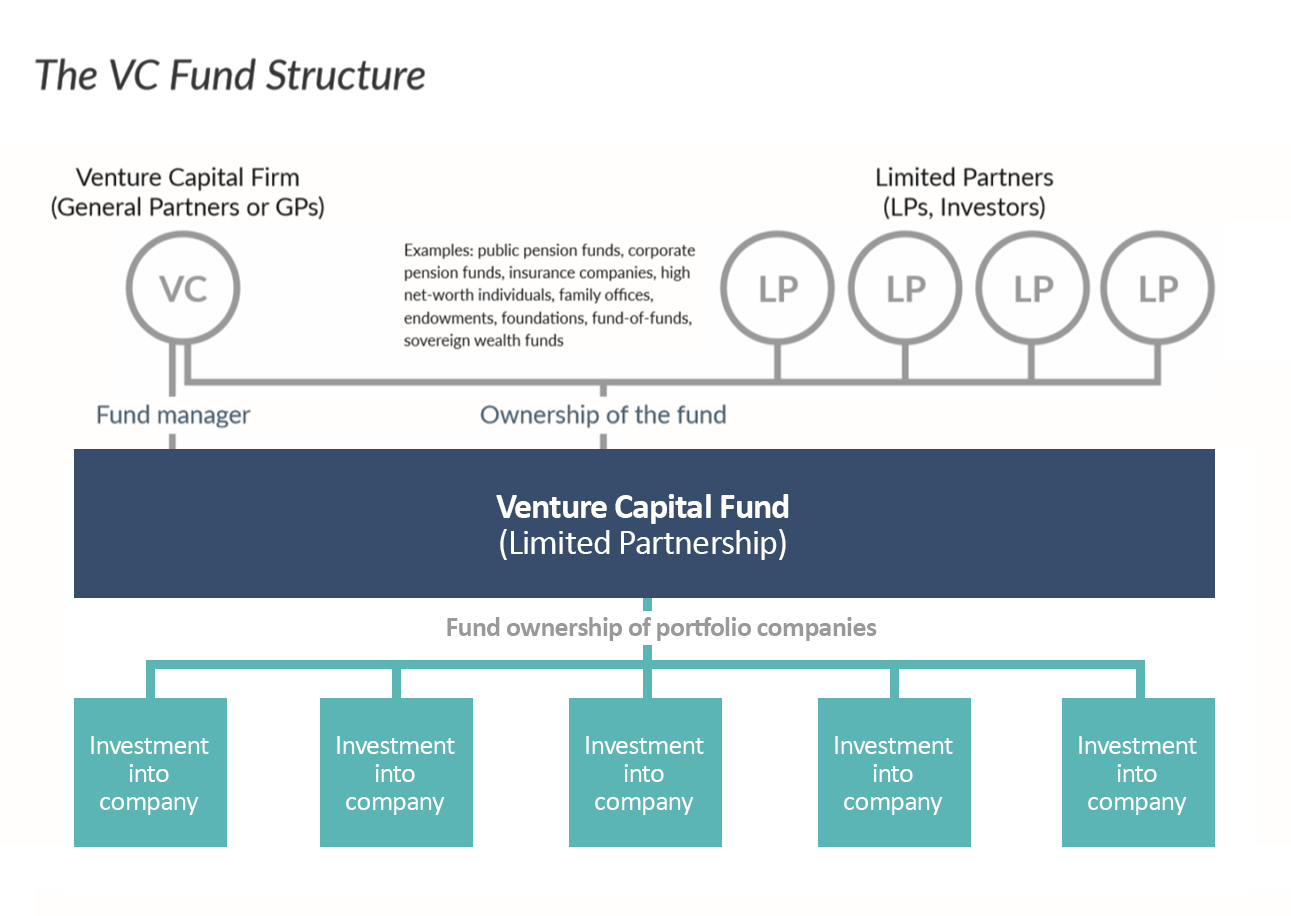

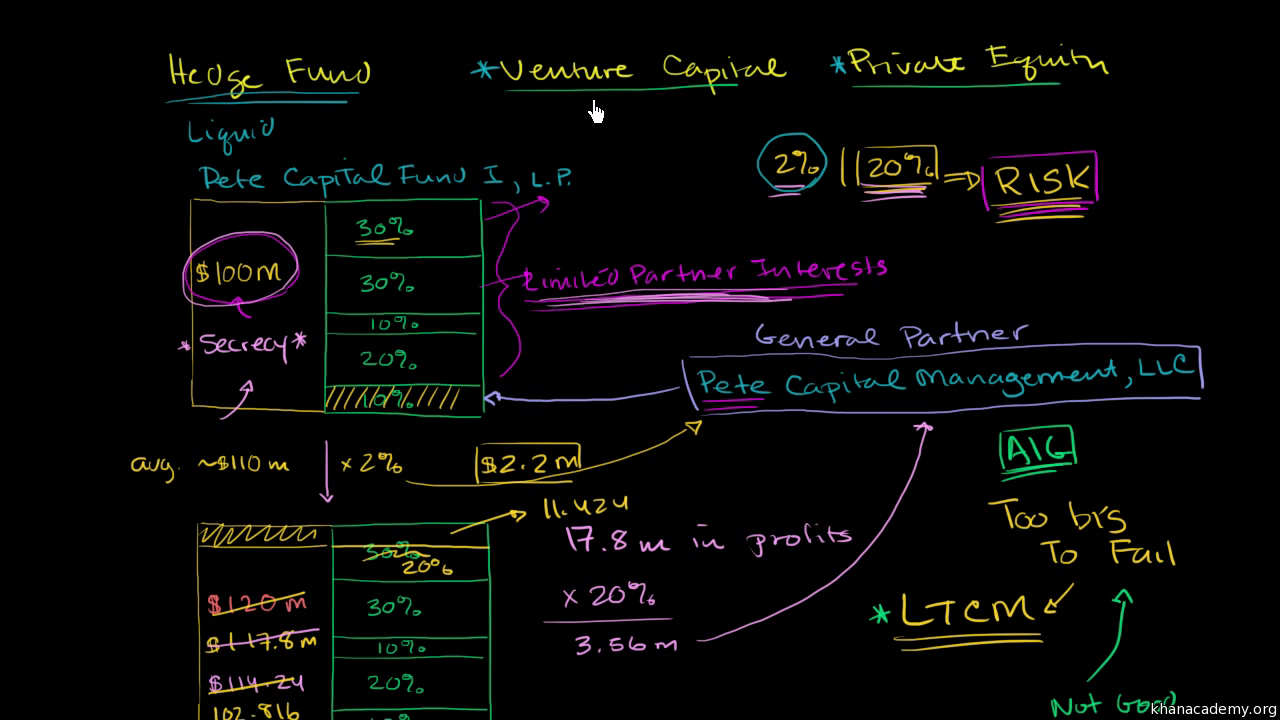

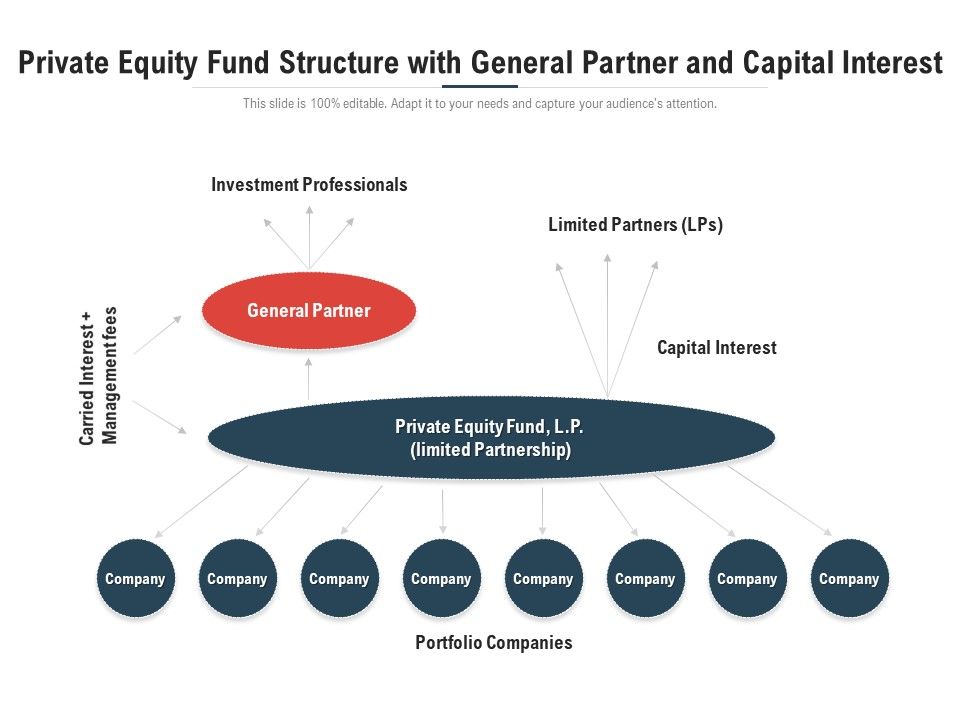

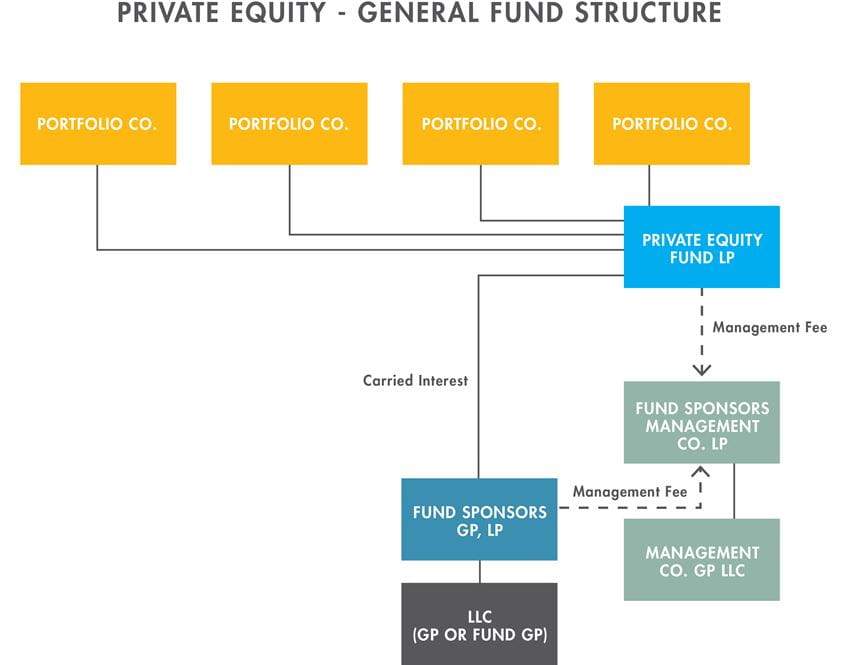

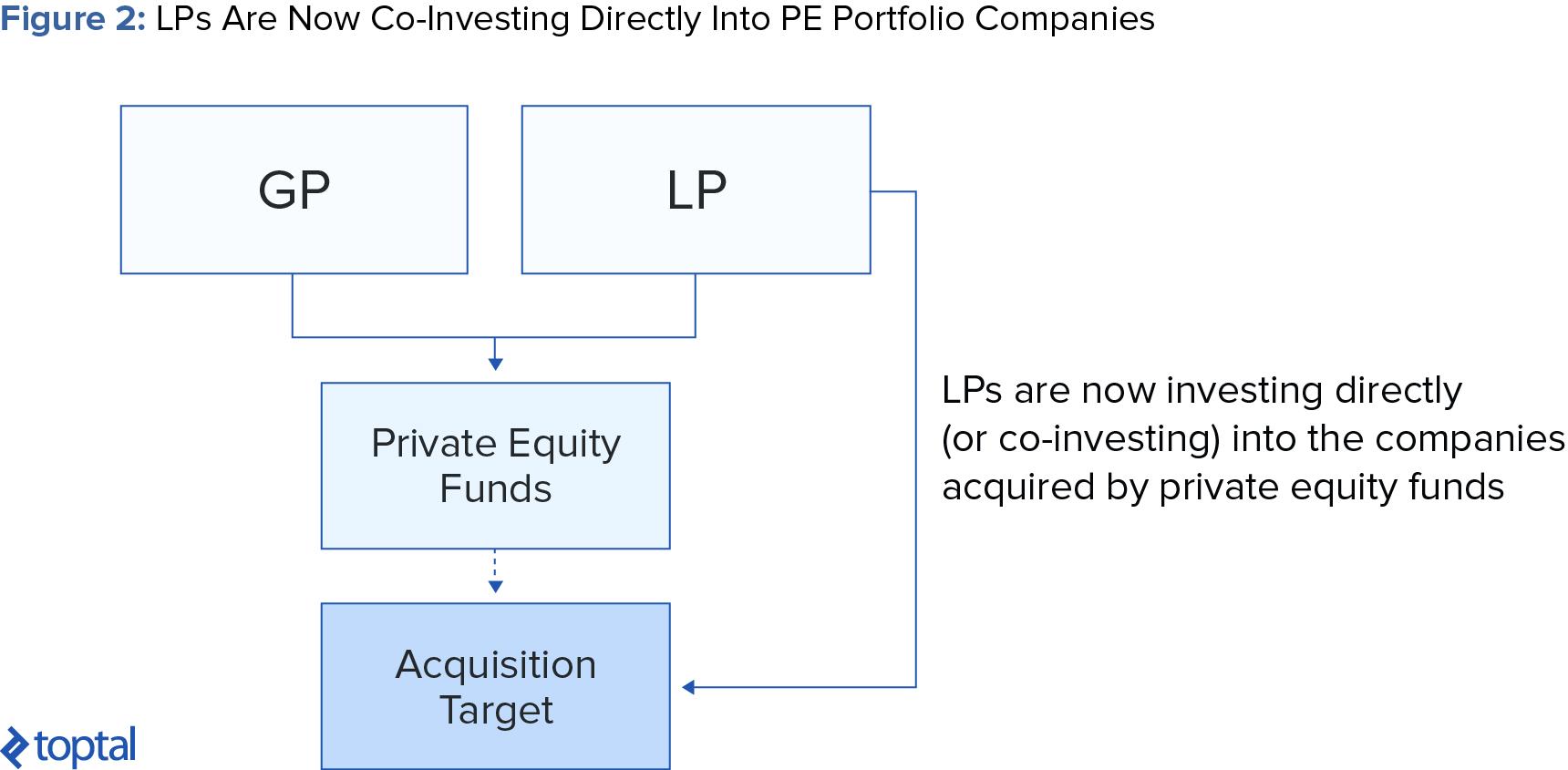

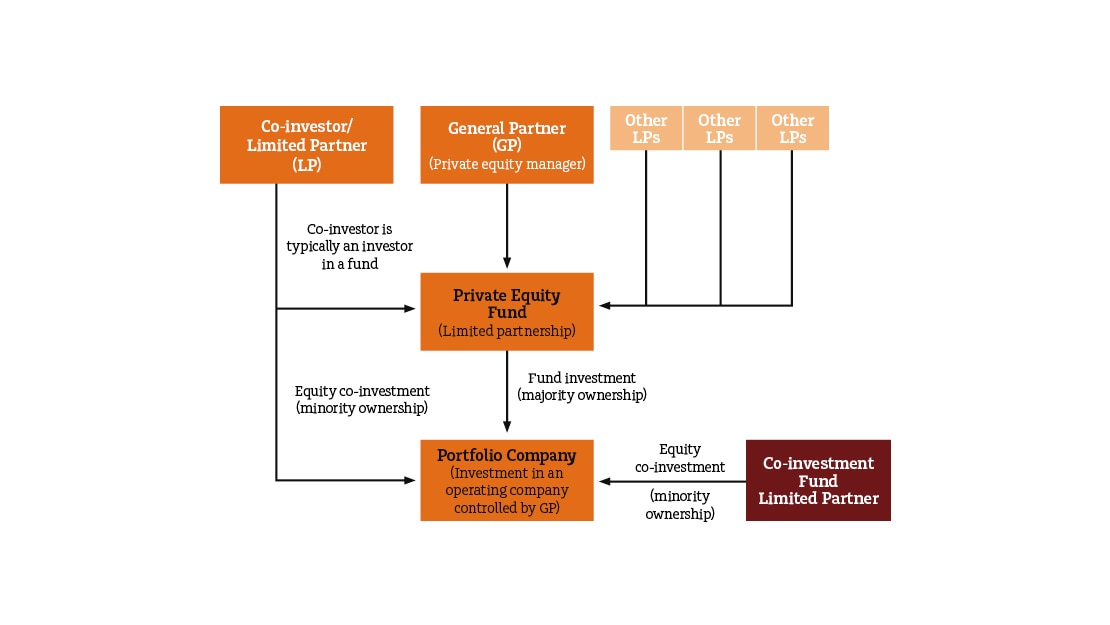

Private equity fund structure diagram. Fund Structure Explained - sourcescrub.com Key Roles Within Private Equity Fund Structures PE funds involve 4 key entities, each with their own responsibilities, rewards, and risks. The Management Company The management company, or private equity firm, is essentially an operating entity that employs General Partners and their investment teams. General Partners LP Corner: US Private Equity Fund Structure - The Limited ... The diagram below illustrates this basic structure. To read more, please click "Read More" to the right below. The diagram above illustrates that passive investors (Limited Partners) invest in the fund, and the fund is managed by the General Partner. PDF Private Equity Fund Governance - IFI Global 8 Fund Structure Preference 10 A Look Ahead ... Private Equity fund Governance: Establishing Best Practices 2017 1 Executive Summary The influence of investors in the private equity industry is growing significantly and has never been as strong as it is today. Vistra, in partnership with IFI Global, conducted a worldwide research study Developing a Private Equity Fund Foundation and Structure ... Most venture and private equity funds use a limited partnership as their legal structure (Figure 2), which involves two main types of actors: (1) a general partner (GP) and (2) limited partners (LPs). The limited partnership is usually a fixed-life investment vehicle, wherein the GP, or the management firm, has unlimited liability and the LPs ...

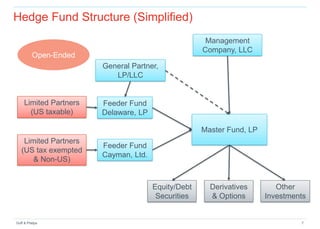

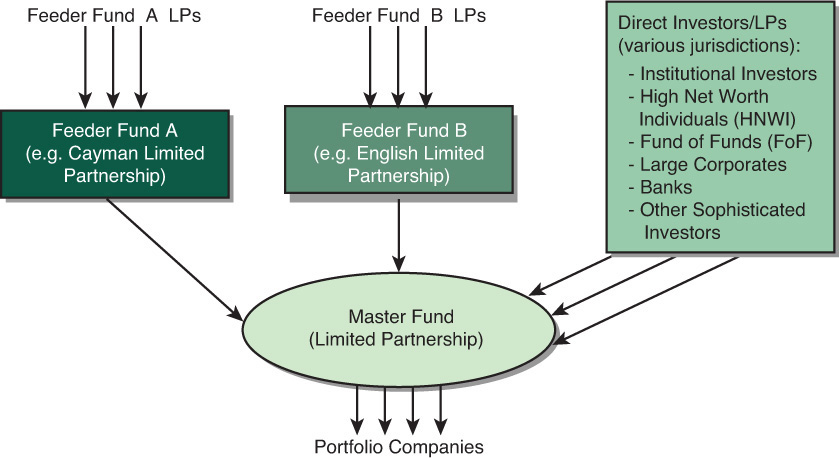

Master-Feeder Structure - Overview, How It Works, Advantages What is a Master-Feeder Structure? A master-feeder structure is an investment structure used by hedge funds Hedge Fund A hedge fund, an alternative investment vehicle, is a partnership where investors (accredited investors or institutional investors) pool under which multiple investors invest in onshore and offshore "feeder" funds, which, in turn, invest in a larger "master" fund. andalusienmarkt.de › private-equity-waterfall-model-xlsKundli - andalusienmarkt.de An American waterfall is the opposite. First wanted to say thanks it s a great spreadsheet. Includes inputs for income and expenses, amortization schedule, and private equity waterfall structure. 1 Private equity. , USA 20006 Phone: 416-941-9393 Fax: 416-941-9307 Email: [email protected] 21, XLS, 861. Below is a private equity waterfall diagram ... PDF Fund structuring options - Financial Services Authority These diagrams do not illustrate all of the entities involved in forming, operating, or managing a fund. This diagram does not provide a definitive illustration of any particular fund structure, any guidance on, or any recommendation in respect of, the structuring of investment funds. ©Financial Conduct Authority Standalone fund Fund Asset 1 Asset How Are Private Equity Firms Structured? Private equity firms are structured as partnerships with one GP making the investments and several LPs investing capital. All institutional partners of the fund will agree on set terms laid out in a Limited Partnership Agreement (LPA). Some LPs may also ask for special terms outlined in a side letter.

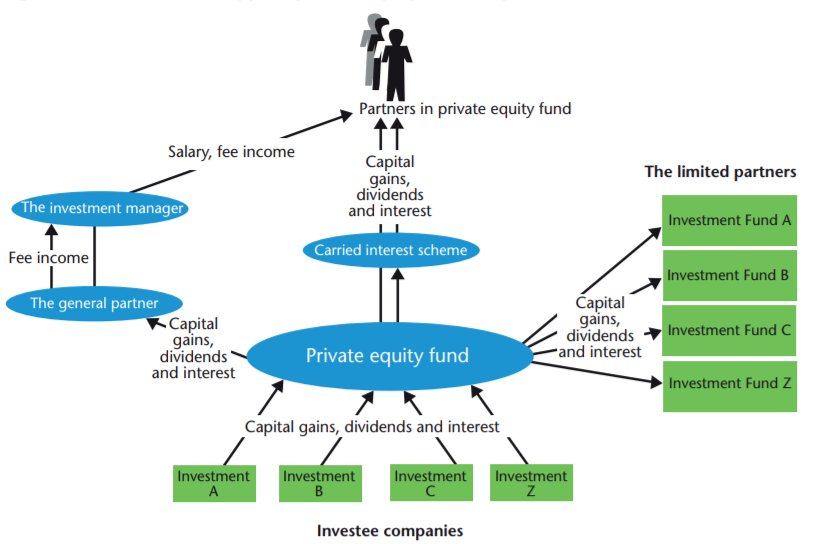

PDF Understanding and Teaching Private Equity Structures ... 3 A good description of real estate private equity fund structure can be found in Andrae Kuzmicki and Daniel Simunac, "Private Equity Real Estate Funds: An Institutional Perspective," Real Property Association of Canada, 2008. PDF Private Equity Fund Formation - MSA Worldwide The structure of a private equity fund generally involves several key entities, as follows: "!The investment fund, which is a pure pool of capital with no direct operations. Investors acquire interests in the investment fund, which makes the actual investments for their benefit (see Private Equity Fund Structure - Investopedia It's common for private equity funds to require an annual fee of 2% of capital invested to pay for firm salaries, deal sourcing and legal services, data and research costs, marketing, and... Private Equity Fund structure: An overview of the types of ... Private Equity Fund structured as a Limited Partnership In the Fund universe, the investors are called Limited Partners. "Limited" because their liability is restricted to the amount of funds they have invested in the Fund. On the other side, we have the General Partners (GPs), who are referred to as the Fund Managers.

› academy › lesson-2-private-capitalWhat Is Private Capital? - Preqin In a commingled fund structure, fund managers raise pools of capital from multiple external investors to form a fund. Fund managers use this pooled capital to invest in companies or assets. Most private capital funds are structured as closed-end investment vehicles, which have a finite lifespan and typically do not allow redemptions or the ...

Private Equity Fund Structure | A Simple Model Private Equity Fund Structure Peter Lynch Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no further funds can be raised.

PDF English and Luxembourg private equity funds: key features ... Private equity funds should be distinguished from: • Hedge funds. These are privately-held investment vehicles that usually have far more wide-ranging, and often opportunistic and short-term, investment and trading strategies than private equity funds. The structure of a hedge fund is usually very different from a typical private equity fund.

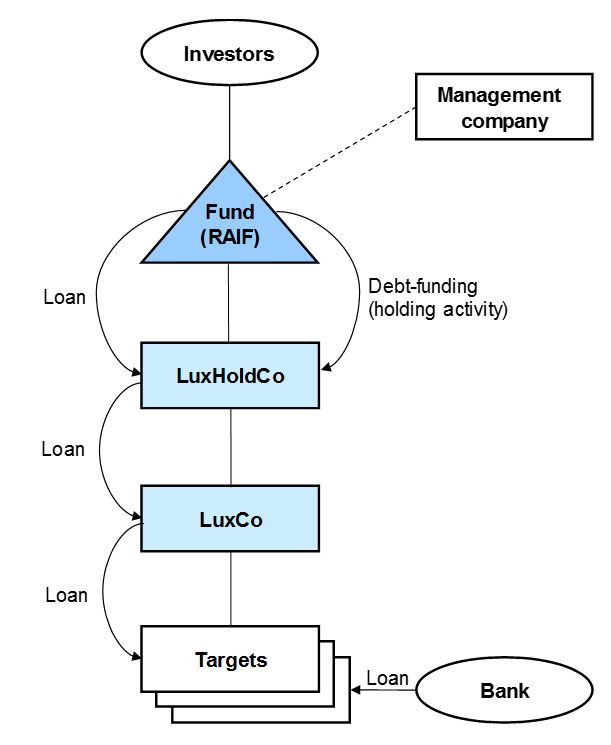

PE fund flows part 1 - Common structure of PE investment ... PE fund flows part 1 - Common structure of PE investment When I first came across PE structure, it was very confusing to see layers of holding companies and why they existed. This a short & simple introduction to a typical PE structure and what the purpose of each holding company is. Below is an example of a typical PE investment structure.

silverhookstudiosinc.us › private-equity-waterfall-modelPrivate equity waterfall model xls - silverhookstudiosinc.us Eloquens. 5 year Pro Forma Cash Flow model to calculate returns from a multifamily investment property. 8x 4 7. The model can be used for private equity real estate funds or any type of individual transaction on a deal-by-deal basis. economic structure of Private Equity (“PE”) fund investments.

What is a Private Equity Waterfall? The preferred method ... Below is a private equity waterfall diagram showing a Preferred Return with two hurdle rates that the investment must reach before the cash flow splits begin to change. The light blue bar (the GP's portion of distributions) becomes larger (or is "promoted") as these performance hurdles are achieved.

VENTURE CAPITAL & PRIVATE EQUITY FUNDS - Morgan Lewis Many private equity fund agreements contain a provision permitting, or under certain circumstances ... fund, modified only to reflect the AIV structure itself and for changes necessitated by legal differences between the vehicles (e.g., Cayman Islands law will govern a Cayman Islands limited partnership).

What is Private Equity Deal: Structure, Flow, Process (Guide) Here is a Structure of a Private Equity Deal 'Sourcing' and 'Teasers' Signing a Non-Disclosure Agreement (NDA) Initial Due Diligence Investment Proposal The First Round Bid or Non-Binding Letter of Intent (LOI) Further Due Diligence Creating an Internal Operating Model Preliminary Investment Memorandum (PIM) Final Due Diligence

PDF BRIEFING NOTE - Loeb Smith As a general matter, closed-ended funds (e.g. a private equity fund or a real estate fund), however structured, are not regulated by the Cayman Islands Monetary Authority ("CIMA") under the Mutual Funds Law (2015 Revision) because the equity interests issued by the ELP are not redeemable or repurchaseable at the option of investors.

Private-equity fund - Wikipedia Diagram of the structure of a generic private-equity fund Most private-equity funds are structured as limited partnerships and are governed by the terms set forth in the limited partnership agreement or LPA.

PDF Fund Structuring & Operations - Nishith Desai As engineers of some of the earliest innovative instruments being used by investment funds (both private equity and venture capital) in India we proactively spend time in developing an advanced under-standing of the industry as well as the current legal, regulatory and tax regime. Choice of Fund Vehicle Structure follows strategy, and not vice ...

study.com › academy › lessonWhat is a Private Investment? - Definition & Overview - Video ... Private investment, from a macroeconomic standpoint, is the purchase of a capital asset that is expected to produce income, appreciate in value, or both generate income and appreciate in value.

Fund Structure - Slide Geeks Fund Structure found in: Co Investment Fund Structure Ppt PowerPoint Presentation Professional Shapes, Private Equity Fund Structure Ppt PowerPoint Presentation Ideas Demonstration Cpb, Sample Of Fund Structure Diagram Ppt..

Islamic Private Equity Fund Structure | Download ... given conventional private equity (pe) expectations, investee portfolio companies would be structured involving 50%-70% debt (stowell, 2013, p.321;hamzah, 2011, p.26), thus ifis could also...

economictimes.indiatimes.com › definitionWhat is Constructive Dismissal? Definition of Constructive ... Apr 13, 2016 · Definition: Constructive dismissal is a situation where the employee is forced to leave or quit his/her job not because they want to, but because of the employer’s conduct. The resignation could be the result of bad working conditions or changes in terms of employment which leaves the employee ...

What's A Waterfall In Private Equity? - ictsd.org Private equity funds pay out distributions after their investments have been liquidated according to a waterfall structure. How Does An Equity Waterfall Work? A typical equity waterfall divides profits equally among the partners of a project. When a project beats expectations, operating partners are given a greater share of profits.

PDF GUIDE TO Private Equity Fund Finance - BVCA Fund and financing structure Fund and financing structure The starting point from the lender and their lawyer's perspective is to understand the fund's structure in detail. Very often the lender's lawyers will need to carry ... Private Equity Fund Finance Equity. documents. 20.

Private Equity Fund Structure Diagram - mungfali.com 32 Private Equity Fund Structure Diagram - Free Wiring Diagram Source. Taxation of private equity and hedge funds - Wikipedia. Fund Structure of Private Equity and Venture Capitalists - FinanciaL ...

› reporting-and-assessment › investorInvestor reporting guidance | Reporting guidance - PRI Oct 22, 2021 · For example, if a fund consists of 50% listed equity and 50% fixed income and accounts for 10% of a signatory’s total AUM – it should be reported as 5% listed equity and 5% fixed income. Why do we automatically get a 1-star score for some of our reported asset classes?

Private Equity Fund Structure | A Simple Model Private Equity Fund Structure. Peter Lynch ; Private equity funds are closed-end investment vehicles, which means that there is a limited window to raise funds and once this window has expired no further funds can be raised. These funds are generally formed as either a Limited Partnership ("LP") or Limited Liability Company ("LLC"). ...

1-Private Equity Fund Structure | Download Scientific Diagram Download scientific diagram | 1-Private Equity Fund Structure from publication: The Patterns of Private Equity Investment in Ireland, 2007 - 2014 | Abstract Over the last decade developments of ...

0 Response to "40 private equity fund structure diagram"

Post a Comment