36 rich dad poor dad assets liabilities diagram

It is the only rule. Rich people acquire assets. The poor and middle class acquire liabilities, but they think they are assets. 5. What is more powerful is financial education. Money comes and goes, but if you have the education about how money works, you gain power over it and can begin building wealth. 6. Dec 24, 2019 — When I wrote “Rich Dad Poor Dad,” I said that your house is not an asset. Rather it is a liability. That was like spraying water on a ...

Assets Versus Liabilities: A Rich Dad Poor Dad Lesson! This article is a guest post from the blog Investors On The Rise. A very important lesson I have learned throughout my self-studies of personal finance is from the book Rich Dad Poor Dad by Robert Kiyosaki.

Rich dad poor dad assets liabilities diagram

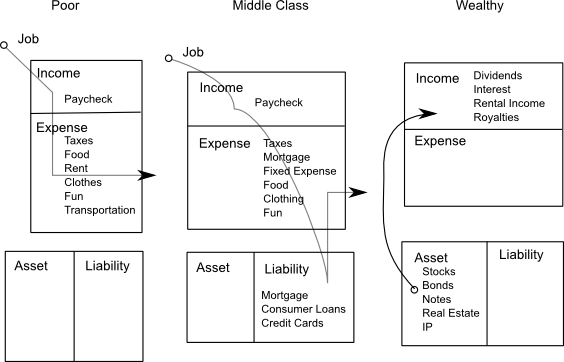

In Rich Dad Poor Dad, Kiyosaki explains that "an asset is something that puts money in your pocket and a liability is something that takes money out of it". It's that simple. Like we already discussed earlier, the rich focus on using their money to make more money (acquiring assets) and the poor use their money to incur liabilities. Robert Kiyosaki's Rich Dad Poor Dad was first published in 1997 and quickly became a must-read for people interested in investing, money, and the global economy. The book has been translated into dozens of languages, sold around the world, and has become the #1 Personal Finance book of all time. In this sense, rich people acquire assets (securities and investments) and poor people add liabilities (commitments and obligations). This is the main difference that can punctuate the future ...

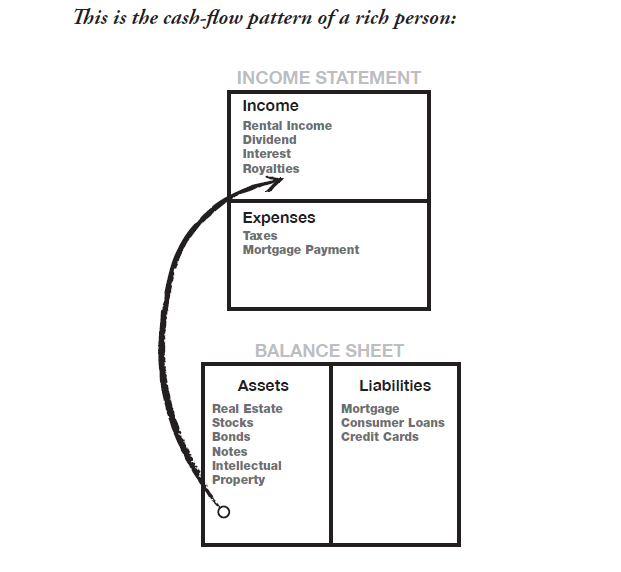

Rich dad poor dad assets liabilities diagram. Investing money in buying more assets that have a higher Return on Investment and reducing your liabilities is the only secret of the rich people getting richer. If you don't know what assets and liability are, here it is: Assets is something that puts money in your pocket, while liability is something that will take money out of your pocket. The famous 'Rich Dad, Poor Dad' book. (Amazon pic) ... He emphasises the value of creating an asset first to cover one's liabilities rather than saving money or relying on a conventional job ... The rich dad has a healthy financial mindset; not the showiest house or the most expensive shoes. While a poor dad works for money and spends practically every penny on liabilities, the rich dad avoids unnecessary purchases and puts his money toward assets that will make him more money. In Rich Dad Poor Dad I taught the Income statement as seen below: This is the cash-flow pattern of an asset: The top part of the diagram is an Income Statement, often called a Profit-and-Loss Statement. ... It's called that because it's supposed to balance assets against liabilities.

Rule #1: You must know the difference between an asset and a liability- and buy assets. "Rich people acquire assets. The poor and middle class acquire liabilities they think are assets," rich dad says. The biggest challenge poor people have is knowing the difference between an asset and a liability. Apr 3, 2020 — How to Identify a Cash Flow Pattern of an Asset (from Rich Dad, Poor Dad) · The rich buy assets. · The poor only have expenses. · The middle class ... You must read "Rich Dad Poor Dad" if you want financial freedom.After reading this book you will become financially educated. This book will provide you financial literacy which you will never get from schools and colleges.This book explains why rich gets more richer and why poor gets more poorer.Rich man invests on assets, poor on expenses ... A fellow investor from Arizona, Shiloh Lundahl, posted a thread on the forums awhile back entitled " Rich Dad investing principles — good or bad? " While the book Rich Dad Poor Dad is ofttimes credited as having shined the light on many principles of personal finance and REI, the question is posed: Is it legit? Is the book that sold millions of copies—and the advice therein—actually ...

By Dr. James M. Dahle, WCI Founder. The online personal finance community can be pretty critical of Robert Kiyosaki the author of the Rich Dad, Poor Dad book series. I've been critical myself. Employees who invest primarily in static asset allocations of low-cost, broadly diversified index mutual funds tend to be especially critical while entrepreneurs and real estate investors tend to be less ... Rich Dad Poor Dad... • Explodes the myth that you need to earn a high income to become rich • Challenges the belief that your house is an asset • Shows parents why they can't rely on the school system to teach their kids about money • Defines once and for all an asset and a liability Robert Kiyosaki is arguably the most influential author in the finance, real estate, and investing space. His book, Rich Dad Poor Dad, has sold over thirty million copies and has been translated into forty different languages across forty different countries.Since its inception in 2002, Rich Dad Poor Dad has become almost every investor's favorite book, prompting them to get out of the rat ... Rich Dad, Poor Dad by Robert T. Kiyosaki. So something funny and interesting happened while I was considering how to approach the topic of this article, I was reading a book on financial education (Rich Dad, Poor Dad) that was recommended by my Capital Markets lecturer (Professor A.R Agom) in Ahmadu Bello University, Zaria in 2009.

Oct 9, 2012 — It's about how much money you keep. Want to be rich? It's about assets vs. liabilities. My poor dad always told me, "You need to read books." My ...

During my regular walk back home I went by this poor guy lying on the street smoking a cigarette. He had this “cozy” living room, an underground tunnel with a nice view to the other side of the street. He might have his own joke to the world, look at his cup, it says: “Who are you?”.

This is almost like Rich Dad, Poor Dad charts. MarcG said, One option is building business(s) as your assets. ... I can see the poor, the middle class, and the rich in those diagrams 😉 ... I think you need to make a diagram that further explains "assets".

Rich people acquire assets , poor and middle class acquire liabilities that they think are assets . Both dads worked hard but they both have different attitude , poor dad said ,"the reason I am not rich is I have you kids " whereas rich dad said ,"the reason I must be rich is I have you kids ". when it comes to money one said," played safe and don't take risk" , the other said," learn to ...

Rich Dad Poor Dad Book Details "Rich Dad Poor Dad PDF" ranks among the top ten personal finance books. Many wealthy people also have the same mindset which Robert Kiyosaki describes in this book. These mindsets contrast with those who are poor. According to Robert, the poor man in this book was his father, and the rich man is Robert's mentor.

Kiyosaki passes on one rule from his rich dad: "You must know the difference between an asset and a liability, and buy assets." The definitions he uses are very simple: Assets are anything that puts money in your pocket. Liabilities are anything that takes money from your pocket.

Also, poor people think that love of money is the root of all evils, and rich people think that lack of money is the root of all evil. These contradictory views come from a lack of financial education. A little bit of financial education can buy us freedom, wealth, and time. The number o n e book to start your financial education is Rich Dad ...

January 18, 2021 by Steve Cummings. After reading the book Rich Dad Poor Dad, most people come under the conclusion that owning assets is better than having liabilities. That is so true. "The rich people acquire assets. The poor and middle class acquire liabilities that they think are assets.". This is at the point where you have to wonder ...

"Rich Dad Poor Dad" was written by Robert T. Kiyosaki, who illustrated how rich and poor think about money. Kiyosaki's own dad, represented the "poor dad" while his friend's entrepreneur ...

Poor dad (Robert' real dad) is earning his income from a job (He is an Accountant but don't know how to become rich) and spend on food, clothes, entertainment, and transportation. Unfortunately, he doesn't have assets but he has liabilities like mortgages, loans, and credit cards.

The rich dad believed in the value of acquiring assets that make you money, not liabilities which may be nice to have, but can end up hurting you in the end. The book revolves completely around the author, Robert Kyosaki, who in the setting of the book began his financial literacy journey with a job working for the "rich dad".

Aug 15, 2019 — In Rich Dad Poor Dad, I introduce three cash flow patterns: one for the ... the balance sheet which displays your assets and liabilities.

Jul 26, 2020 — We'll get more into distinguishing assets vs liabilities in the next section, but the main point here is that wealthy people use their Income to ...

Aug 4, 2020 — Rich Dad's Definition of an Asset and a Liability ... What's the difference of assets vs liabilities? Asset: “An asset puts money in your pocket.”.

In his classic "Rich Dad Poor Dad," Kiyosaki highlights that the rich know the difference between an asset and liability. Assets: Put money into the pocket. Liabilities: Take money out of ...

Rich Dad's Definition. In the book Rich Dad Poor Dad, Robert Kiyosaki defines "asset" as anything that puts money in your pocket. "Liability" is anything that takes money out of your pocket. For example, is an owner-occupied home considered an asset or liability? Since it is taking money out of your pocket, Robert says it is a liability.

Rich dad poor dad book primarily focuses on the concept of financial education. Financial education means instead of chasing money for a living you focus and build assets that bring you money. In addition to the point, we can say money is a form of power however what's more powerful than money is financial education .

Dec 12, 2017 — Rich dad pointed out that confusion happens for many because accepted methods of accounting allow for the listing of both assets and liabilities ...

Today, Robert Kiyosaki explores one of the four basic assets, Paper, with Andy Tanner and John MacGregor. While Robert will admit he typically stays away from this class of assets, up to 90% of people fall into this category. Paper includes stocks, bonds, mutual funds, ETF, and cash. Andy Tanner is an advisor on the Rich Dad Radio Show on paper assets. He is the author of Stock Market Cash ...

In this sense, rich people acquire assets (securities and investments) and poor people add liabilities (commitments and obligations). This is the main difference that can punctuate the future ...

Robert Kiyosaki's Rich Dad Poor Dad was first published in 1997 and quickly became a must-read for people interested in investing, money, and the global economy. The book has been translated into dozens of languages, sold around the world, and has become the #1 Personal Finance book of all time.

In Rich Dad Poor Dad, Kiyosaki explains that "an asset is something that puts money in your pocket and a liability is something that takes money out of it". It's that simple. Like we already discussed earlier, the rich focus on using their money to make more money (acquiring assets) and the poor use their money to incur liabilities.

0 Response to "36 rich dad poor dad assets liabilities diagram"

Post a Comment